Digital non-physical money refers to monetary value that exists only in electronic form — used for payments, savings, transfers, and more — without any tangible banknotes or coins. It includes bank deposits, digital wallets, central bank digital currencies (CBDCs), stablecoins, and cryptocurrencies such as Bitcoin or Ethereum. This article explains what it is, how it works, its advantages and drawbacks, pricing and fees, expert perspectives, country-wise availability, comparisons with traditional money, and how people actually use each type.

“A central bank digital currency is a digital form of a country’s money issued and backed by the nation’s central bank.” — Britannica on CBDCs.

Table of Contents

What Is Digital Non-Physical Money?

In simple terms, digital non-physical money is money that exists purely as electronic entries in ledgers, apps, networks, or databases. It is not printed or minted — instead, it’s accessed through devices and networks.

Core Types of Digital Money

| Type | Who Issues/Controls It | Example | Legal Tender? |

| Bank Deposits | Commercial banks | Your bank balance | Yes (via legal framework) |

| E-money / Digital Wallets | Fintech companies | PayPal wallet | Depends on regulatory framework |

| CBDCs | Central banks | Digital Yuan | Yes |

| Stablecoins | Private issuers | USDC | No |

| Cryptocurrencies | Decentralized networks | Bitcoin | No |

Key Characteristics

- Exists electronically, not physically.

- Can be used for payments, savings, and transfers.

- May be centralized (banks, CBDCs) or decentralized (crypto).

- Governed by different regulations and risk profiles.

How Digital Money Works – Ledger & Creation

Digital money isn’t magic — it’s ledger entries that record value and transactions.

Money Creation Snapshot

- Most digital money is created when:

- Banks issue loans (creating deposits)

- Central banks issue CBDCs

- Crypto protocols mint new coins

| Creation Mechanism | Controller | Backing | Example |

| Bank Deposit | Bank | Credit + Reserves | Savings account |

| CBDC | Central bank | Sovereign backing | e-Rupee |

| Crypto minting | Protocol | Algorithm | Bitcoin mining |

Bank deposit vs CBDC: Your online bank balance is not central bank money — it’s a commercial bank liability. CBDCs are direct liabilities of the sovereign monetary authority.

Key Aspects of Digital Money

Let’s break down the core aspects people care about — usability, cost, governance, and stability.

- Accessibility

- Bank deposits available to anyone with a bank account.

- Digital wallets require smartphone + identification.

- Crypto can be accessed with internet and wallet software.

- Stability

- Bank deposits: stable and insured (in many countries).

- CBDCs: stable (governed by central bank).

- Stablecoins: stable if properly collateralized.

- Cryptocurrencies: volatile.

- Transfer Speed

- Instant in many digital systems.

- Cross-border transfers depend on rails.

- Privacy

- Bank/CBDC: regulated and traceable.

- Crypto: pseudonymous, depending on design.

Country-Wise Availability & Adoption

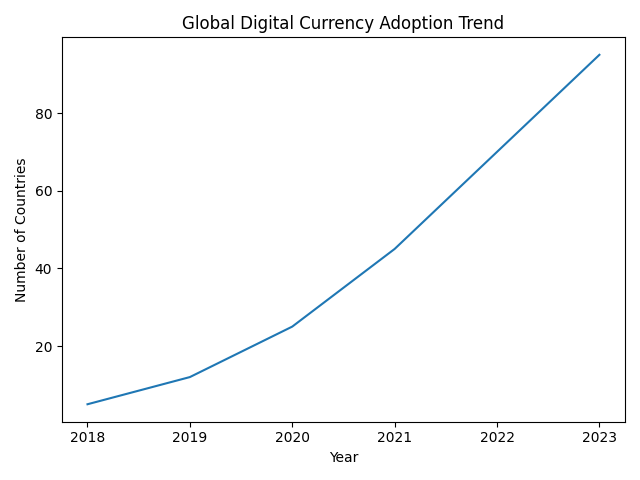

Digital money isn’t equally mature across the world. Some countries have fully deployed digital currencies, others are piloting CBDCs, while most rely on bank and e-money systems.

| Country / Region | Status | Notes |

| Bahamas | CBDC launched | Sand Dollar active |

| Nigeria | CBDC launched | e-Naira in circulation |

| Jamaica | CBDC launched | JAM-DEX legal tender |

| China | Advanced CBDC pilot | e-CNY in wide use |

| India | Pilot CBDC (Digital Rupee) | Retail & wholesale trials |

| U.S. | No CBDC planned (for now) | Fed exploring research |

| EU | CBDC exploration ongoing | Digital Euro in planning stage |

| Kenya | Strong mobile money (no CBDC) | M-Pesa groundwork |

As of now, over 130 countries representing ~98% of global GDP are exploring CBDCs in some form.

Examples & Real-World Usage

Bank & Wallet

| Usage | Example |

| Everyday payments | Debit / credit transactions |

| Salary receipt | Direct bank transfer |

| Peer-to-peer transfers | PayPal / Venmo / UPI |

CBDCs

- Digital Yuan (China): used in retail, travel, healthcare.

- e-Rupee (India): pilot for payments and transfers.

- Sand Dollar (Bahamas): financial inclusion thrust.

Cryptocurrencies

| Crypto | Typical Use | Risk Level |

| Bitcoin | Store of value / payment | High volatility |

| Ethereum | Smart contracts / DeFi | High volatility |

Pricing & Fees

Unlike physical cash, digital money often involves fees — which vary by provider and country.

Bank & Wallet Fees

| Provider Type | Typical Fees | Notes |

| Bank transfers | $0 – $30+ | Depends on type & bank |

| Digital wallets | 0–3% per transaction | e.g., PayPal, Apple Pay |

| International remittances | Varies | Can be costly |

Crypto Fees

| Fee Type | Typical Range | Notes |

| Transaction fee | $1 – $50+ | Depends on network load |

| Exchange fee | 0.1%–1%+ | Depends on exchange |

| Wallet withdrawal | Varies | Exchange-dependent |

CBDC Pricing

CBDCs typically aim for minimal pricing for routine payments; exact fees depend on country policy and infrastructure.

Specialists & Expert Opinions

Economists & policy experts debate digital money’s benefits and risks. Some key insights:

- CBDCs could boost financial inclusion and payment efficiency.

- Risks include privacy concerns, system vulnerability, and surveillance potential. IMF research cautions against data exposure risks with programmable CBDCs.

- Crypto proponents say decentralized money empowers users but face volatility and regulatory uncertainty.

Top specialists to consult:

| Expert / Organization | Focus |

| Central banks | Monetary policy & CBDC design |

| IMF & World Bank | Financial inclusion & oversight |

| Crypto researchers | Decentralized systems |

Pros & Cons

Digital money offers numerous advantages that make it increasingly popular worldwide. It enables instant global transactions, allowing users to send and receive funds across borders within seconds. Transaction and processing fees are often lower than traditional banking systems, making it cost-effective for businesses and individuals. Users benefit from 24/7 access to their funds without depending on bank operating hours. Digital money also promotes financial inclusion by providing access to financial services for unbanked populations.

Blockchain-based systems enhance transparency through secure and traceable record-keeping. Additionally, it supports peer-to-peer transfers without intermediaries, enables smart contracts and automation, and provides seamless convenience for online shopping and digital services.

Cons

Digital money also comes with several disadvantages that users must consider. Price volatility—especially in cryptocurrencies—can lead to significant financial losses within short periods. There are ongoing cybersecurity and hacking risks, as digital wallets and exchanges can be targeted by cybercriminals. Regulatory uncertainty across countries creates confusion and legal risks for users and businesses.

Privacy concerns arise due to potential data tracking and surveillance. Digital money depends heavily on internet access and technological infrastructure, limiting use in areas with poor connectivity. Transactions are often irreversible if sent incorrectly, and acceptance remains limited in some regions. Additionally, scams and fraudulent schemes are common in the digital finance space.

Digital Money vs Traditional Cash

| Feature | Digital Money | Physical Cash |

| Tangibility | No | Yes |

| Speed | Often instant | Slower |

| Traceability | High | Low |

| Cost | Varies | Mostly zero |

| Accessibility | Requires tech | Universal |

Price & Cost Comparison

| Service | Base Fee | Typical Range | Notes |

| Bank transfer | $0 – $30 | Depends on bank & type | Cross-border costs add up |

| Digital wallet | 0 – 3% | Merchant fee | Some free peer transfers |

| Crypto transfer | Network fees | Highly variable | E.g., Ethereum gas |

| CBDC transfer | Minimal | Policy dependent | Expected low cost |

Global Digital Currency Adoption

Reviews and User Experience

Although not product reviews, user sentiment across systems:

| System | User Feedback (General) |

| Mobile wallets | Easy & fast |

| Bank deposits | Trusted but slow cross-border |

| Cryptocurrencies | Innovative but volatile |

| CBDCs | Promising but privacy concern |

Future Trends

Key routes for digital non-physical money:

- Wider CBDC pilot expansion (over 130 countries).

- Hybrid systems combining private wallets + CBDCs

- Programmable money for conditional payments

- Reduced physical cash usage

Conclusion

Digital non-physical money is no longer futuristic — it’s dominant in everyday life. The most important question isn’t “digital vs physical” but who controls and governs the ledger — banks, central banks, or decentralized networks. Understanding these differences helps individuals, businesses, and policymakers make smarter decisions in an increasingly digital economy.